Contents

Churn MRR is the total amount your business loses due to subscription cancellations over a specific month. Most people know that having good products or services and marketing them well is important to running a successful business. But it’s equally important to keep an eye on your financial metrics because you are what you measure. To calculate ARR, divide the total contract value by the number of relative years. For example, if a customer signs a four-year contract for $4000, divide $4000 by four for an ARR of $1000/year.

ARR is used mainly as a general comparability between multiple tasks to determine the expected fee of return from each challenge. Assuming the company is growing, then Forward Revenue will all the time be greater than ARR and subsequently, EV/Forward Revenue will all the time be lower than EV/ARR. Annual Recurring Revenue, or ARR, is a subscription financial system metric that reveals the money that is available in every year for the life of a subscription .

Churn MRR

It offers a way more realistic picture of where a business stands month to month. In order to smooth out variations from month to month, some firms may calculate ARR based mostly on their quarterly MRR, ie. Instead of looking at just one quantity for ARR, it’s most necessary to take a look at the development over time to see how briskly a company is rising. In both of these multiples, the Enterprise Value stays constant, it is the measure of revenue that is changing.

We ask corporations to include solely the 12 month values of these contracts, to get apples-to-apples comparisons between companies. Some firms in their inside reporting, when they report or speak about bookings, only embrace new bookings, which may or might not embrace growth contracts with present customers. Most SaaS firms track earnings, corresponding to, Bookings, Billings, Recognized Revenue , ARR or MRR. Some firms track bookings, ARR and acknowledged revenues, others observe billings. Sometimes companies solely embrace recurring revenues after they speak about bookings or billings, but additionally they promote Professional Services . Annual Recurring Revenue, or ARR, is an insightful metrics for B2B SaaS companies to track the entire dollar quantity that is available in yearly throughout a buyer’s annual contract.

- Both ARR and MRR are both nice methods to trace and contextualize your recurring revenue at completely different ranges.

- When you break down the MRR into more specific types, each type offers distinctive insights into revenue, customer behavior, and business health.

- The accounting price of return is the percentage fee of return anticipated on funding or asset as in comparison with the initial funding value.

- Wynk Music is the one-stop music app for the latest to the greatest songs that you love.

- Accrual accounting is an accounting method that acknowledges financial events individually from when the cash is collected.

Abbreviation of ARR, definition of ARR, Explanation of ARR, Full forms of short form ARR. Is quite excited in particular about touring Durham Castle and Cathedral. This procedure makes it more straightforward to look at another item project against a cost-cutting undertaking or other https://1investing.in/ serious tasks. The idea of net income, or earnings after taxes and depreciation, is perceived utilising this procedure. This is a significant thought while assessing a venture recommendation. Project A should be considered as it will yield better results for the organisation.

Depreciation is one of the direct costs that reduce the value of assets. This is how you estimate the total demand for your hotel while not considering the rate, restriction, and capacity constraints. In this, you would want your guests to make full payment against their reservations before the arrival date.

Neural Nets transforming the world of search engines

Associations and organisations utilise the ARR to survey different capital budgeting choices and investment opportunities. An approach to accounting profits includes taking an investment’s initial valuation and revising for the cash flow that accompanies owning the asset. Prior to focusing on capital investment, an organisation might utilise ARR to ascertain the speculated cash flow that a resource or investment can give. They can likewise utilise this equation to check whether a venture they’ve previously made was a plausible one. Contraction MRR is the amount your business loses due to subscription cancellations and downgrades during a particular month.

Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. ARR is a non discounted cash flow system, while IRR is a discounted cash flow system. The former does not take into consideration the present value of the future returns of the project, while the latter does.

Accounting Rate of Return Example-

Today, our copy will not be the same usual piece – talking about how to adopt the right hospitality technology solutions, how they help you, and how to serve guests better. We will spend some time looking at some of the hospitality industry terms. Accounting Rate of Return, also known as theAverage Rate of Return is a financial ratio used in capital budgeting. ARR is the ratio of profit to the amount of investment made in the project.

Positive Expansion MRR indicates that you were able to retain your customers by gaining their satisfaction and loyalty. This is great for your bottom line because there is no Customer Acquisition Cost involved in these sales to existing customers. Accrual accounting is an accounting method that acknowledges financial events individually from when the cash is collected.

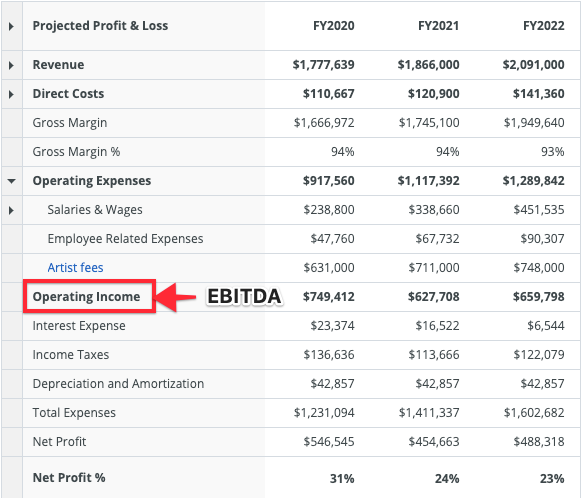

The metric includes all non-cash expenses, such as depreciation and amortisation, and so does not reflect a company’s return on actual cash flows. On the off chance that an organisation has a limited budget and several investment prospects, decision-makers will work together to gauge the typical rate of return on every proposition. The ARR will give them an obvious sign of which activities are probably going to be the most beneficial for the organisation. The ARR equation can likewise be utilised to decide if an undertaking has arrived at its targets and assumptions. After all, operating expenses, taxes, and interest involved with implementing the investment or project have been subtracted, and this will be the leftover revenue. For this, you need to divide the total gross operating profit by the total number of rooms available.

This makes it easy for an investor to get an estimate of the profit potential of projects and investments. Based on this, you can assume that you will make sales worth $90,000 or more in April. If your sales increase by arr stands for 6-8% each month consistently, a standard sales estimate for April would be $94,800. With MRR you can assess the present financial health of the business and project the future earnings based on the active subscriptions.

Purpose of Accounting System | Definition, Features and Examples

It allows you to update hotel rates by adding/subtracting a certain amount or percentage from the base rate. Registering 37 per cent YoY growth, Paytm’s merchant payment volume for the two months that ended in November touched Rs 228 lakh crore. The average monthly transacting users on Paytm Super App reached 84 million, recording a 33 per cent YoY increase. One of the most important metrics in the subscription business is Monthly Recurring Revenue . For most companies, ARR is the sum of all new business subscriptions and upgrades , minus downgrades and cancelled subscriptions.

In other phrases, two investments would possibly yield uneven annual income streams. As said, the ARR is the annual share return from an funding based on its preliminary outlay of cash. Annual Recurring Revenue is probably the most frequently used metric in SaaS. ARR ought to be calculated for annual phrases – with a one-12 months minimal.

As a subscription firm, it’s this recurring income that underpins your pricing technique and enterprise model – that is why it is important to have a solid understanding of these metrics. In the ARR calculation, depreciation expense and any annual costs have to be subtracted from annual income to yield the web annual profit. Even non-recurring income startups use ARR after they need to describe the scale of their enterprise . ARR is an easy and exquisite metric as a result of it’s straightforward to understand and provides a transparent sense of scale.

This is the activity of tracking, managing, and responding to the guest reviews published online – review/booking sites. An estimate of the number of rooms that you expect to sell on a particular day or period of time. An aggregator that derives your rates and availability from OTAs, your website, and other sales channels and presents the same to their end-users. Refers to the restriction policy that you may apply to determine the minimum number of nights a guest must book.